Precious Metals Hit All Time Highs Across the Board

10 October 2025

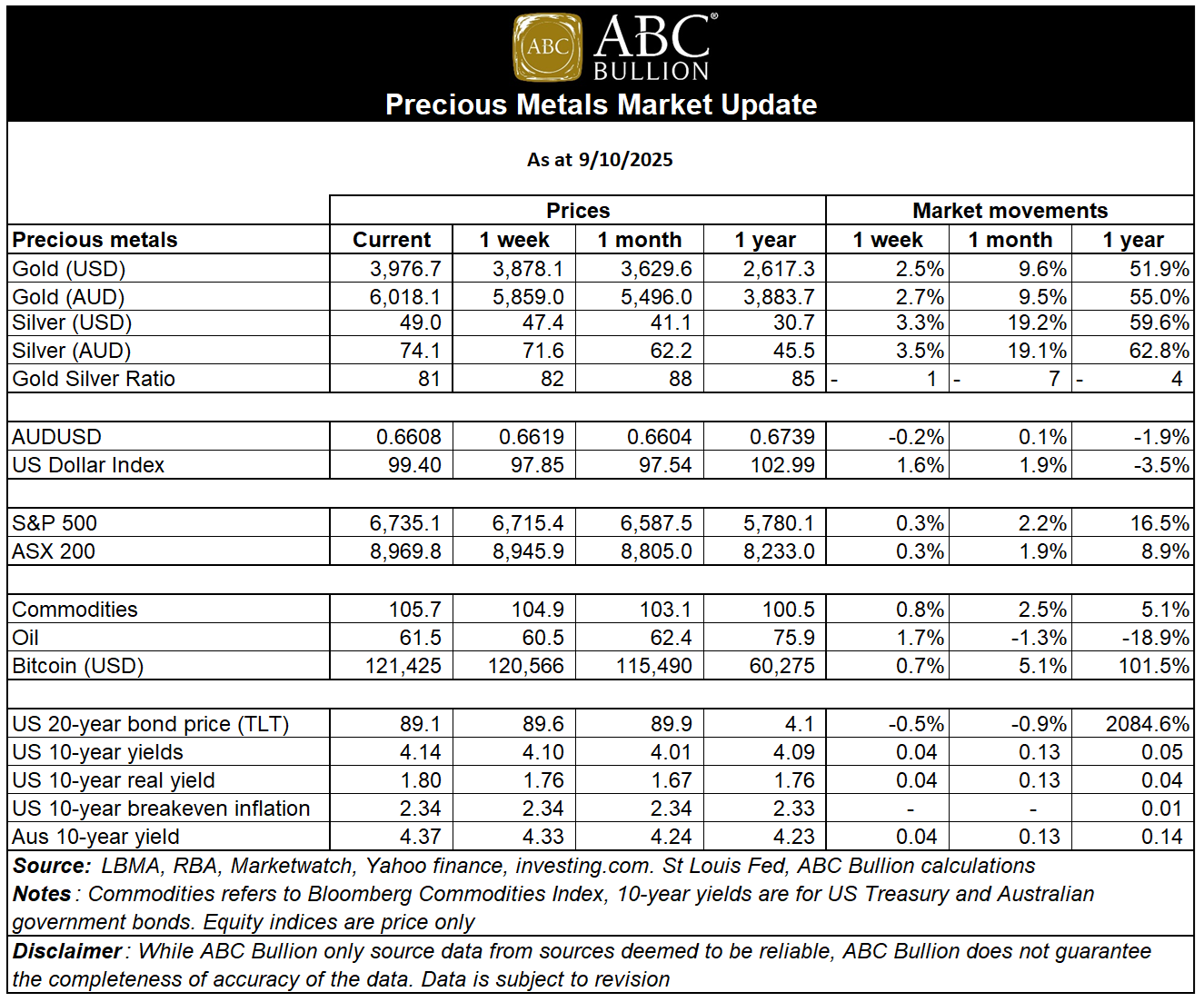

Gold prices rose notably week on week, gaining 2.5% in USD terms to $3,976oz at the time of writing

The rise in Australian dollar terms was stronger, increasing by 2.7%, with local investors boosted by a 0.2% decrease in the Australian dollar to USD $0.6608.

Silver performance was also strong this week, gaining by 3.3% and 3.5% in USD and AUD terms respectively. Breaking above its previous all-time high in 2011 (USD $49.45oz), reaching an intraweek high of $51.24oz.

Platinum advanced 2.6% to USD $1,618oz and 2.8% to AUD $2,448oz. The gold-to-platinum ratio remains well above its long-term mean (1.07:1) at 2.45:1, with this valuation gap suggesting the potential for mean reversion.

2025 has been a stellar year to date across precious metals, with gold, silver and platinum recording exceptional price gains, with an increase of 52% for gold, 69% for silver and 77% for platinum (USD terms).

Risk assets delivered a muted performance this week: The S&P 500 and tech-heavy NASDAQ rose 0.3% and 0.8% respectively, with the ASX 200 gaining by a marginal 0.3%.

The exceptional returns for gold and silver continue to be driven by a range of fundamentals, including strong central bank & ETF buying, further anticipated monetary easing by the U.S. Federal Reserve, a weakening of the USD, heightened geopolitical risk and more recently, an ongoing government shutdown in the U.S.

Despite inflation remaining above the Feds 2% target, continued rate cuts are expected given a weakening job market in the U.S. Markets are currently pricing in a 97.4% and 76.9% probability of a 25-basis point cut in October and December respectively. Potentially bringing the target rate down to 3.50% - 3.75%.

Should the Fed deliver on these cuts, history would suggest it will provide a tailwind for precious metal prices, with gold rallying substantially during rate cutting cycles this century as a defensive asset in comparison to cash and term deposits due to its non-yielding characteristics.

Bitcoin saw a marginal gain intraweek, hitting a fresh record high of USD $124,725. The recent price surge has been fuelled by growing institutional adoption, particularly of cryptocurrency ETFs and geopolitical uncertainty.

We’re pleased to share that ABC Bullion has released updated 2025 editions of our SMSF trustees and Precious Metal Investor Guides. Each report features refreshed insights, including a foreword on current market fundamentals, updated performance returns comparing gold and silver returns against major asset classes to the end of FY25, and a new section introducing the ABC Bullion Gold Decumulator Program.

Thank you for choosing ABC Bullion.

Jordan Eliseo

General Manager, ABC Bullion

Luke Tyler

Market and Business Analyst, ABC Bullion

Disclaimer: This document has been prepared by Australian Bullion Company (NSW) Pty Limited (ABN 82 002 858 602) (ABC). The information contained in this document or internet related link (collectively, Document) is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence any person in making a decision in relation to any precious metal or related product. To the extent that any advice is provided in this Document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of any precious metal or related product, you should obtain independent professional advice before making any decision about whether to acquire it. Although the information and opinions contained in this document are based on sources, we believe to be reliable, to the extent permitted by law, ABC and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice, and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances. To the extent possible, ABC, its associated entities, and any of its or their officers, employees and agents accepts no liability for any loss or damage relating to any use or reliance on the information in this document. It is intended for the use of ABC clients and may not be distributed or reproduced without consent. © Australian Bullion Company (NSW) Pty Limited 2020.