Precious Metals Surge to New Highs Amid Rising Yields and Geopolitical Risk

23 January 2026

Precious metals continued their monumental rally over the past week, with gold breaking successive all-time highs, nearing USD $4950 per troy ounce (oz), with silver pushing toward new records near US$97oz amid heightened safe-haven demand.

Spot gold gained strongly as risk aversion gripped markets, while silver and platinum also traded near multi-year highs, with the three metals returning 14%, 35% and 28% year to date (in USD terms) respectively at the time of writing.

What can we expect throughout 2026?

Forward-looking price expectations remain constructive for precious metals.

A recent LBMA analyst survey outlined a robust consensus forecasts for 2026, with average price projections of USD $4741oz for gold, $79oz for silver, $2222oz for platinum and $1738oz for palladium.

Major investment banks continue to reinforce this bullish outlook, with UBS recently forecasting gold to reach USD $5000oz by end-March, while noting that a further escalation in geopolitical tensions could drive prices as high as $5400oz.

These forecasts underscore the market’s growing recognition of gold’s role as a strategic hedge amid sustained macroeconomic uncertainty, elevated sovereign debt levels, a spike in bond yields (see more below) and heightened monetary uncertainty.

What factors are currently influencing markets?

Ongoing trade-war dynamics and geopolitical risk are providing clear directional drivers for precious metals. Escalating tariff threats between the U.S. and Europe (including Trump most recently proposing 10% tariffs on eight European countries) and tensions around Greenland’s sovereignty have rattled markets and boosted haven demand.

Simultaneously, ongoing developments in Venezuela and Iran are keeping risk premiums elevated. Such tariff risks recently weighed on equity markets (S&P 500 and Europe’s Stoxx 600 closing 2.1% and 0.7% lower respectively) and credit markets, whilst supporting precious metal accumulation as a defensive hedge.

A key macro driver this week has been the renewed rise in long-term bond yields across major global markets. 10-year U.S. Treasury yields climbed to 4.30% this week, up from a recent low of 4.14%, while Japanese long-term yields also moved sharply higher. The 10-year JGB yield rose 12 basis points to 2.31%, and the 40-year yield increased by approximately 30 basis points to 4.11%, underscoring mounting pressure across global sovereign debt markets.

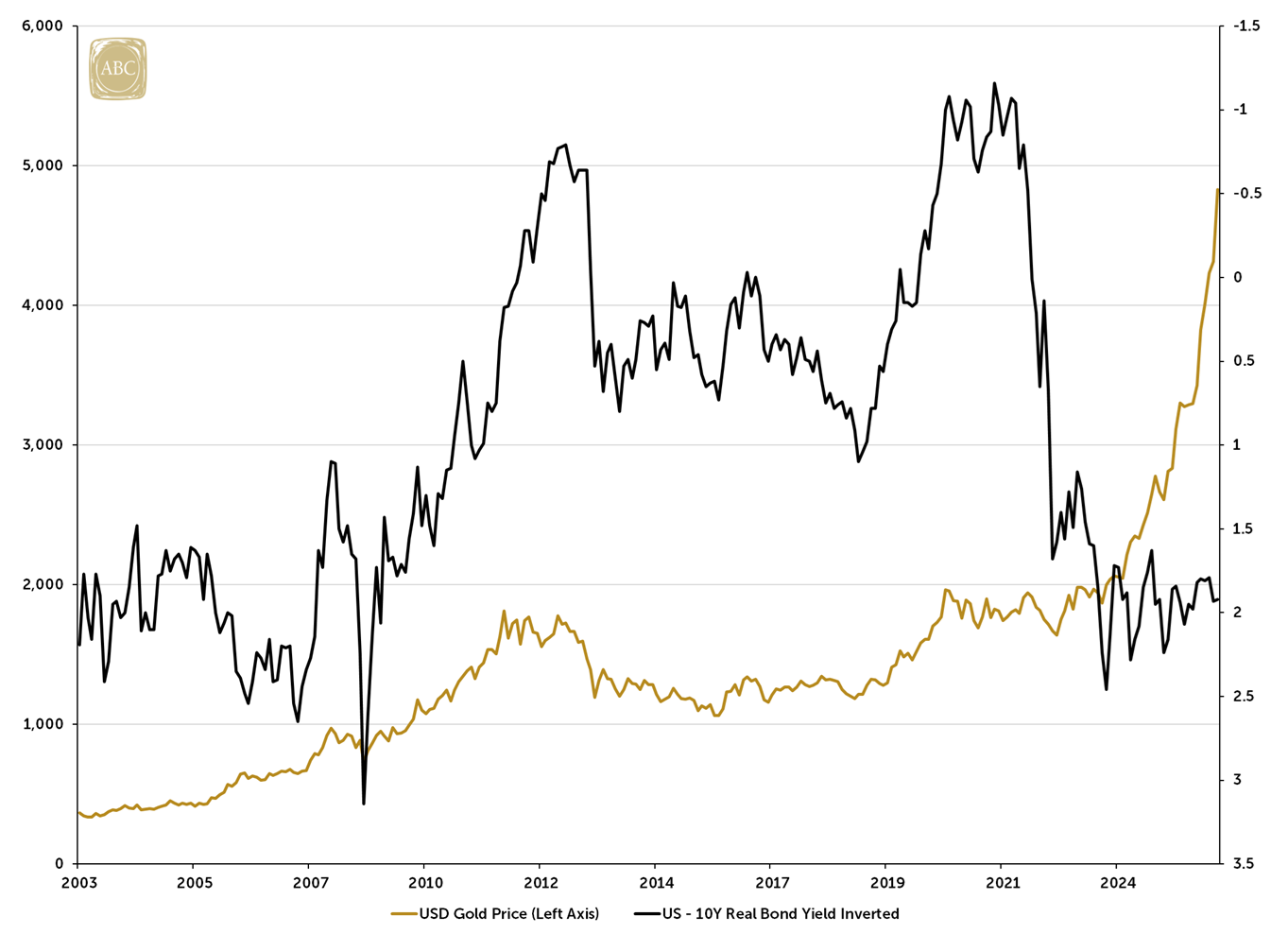

Historically speaking, rising yields have tended to weigh on gold due to higher opportunity costs. However, this relationship inverted in 2022 (Figure 2) and has remained structurally altered. Gold and long-term yields have increasingly risen in tandem since, reflecting investor demand for protection against expanding fiscal deficits, elevated government debt-to-GDP ratios (currently 118% and 248% for the US and Japan respectively) and growing concerns around sovereign credit risk.

This dynamic has reinforced gold’s role not only as an inflation hedge, but as a systemic risk hedge, particularly as debasement-trade sentiment strengthens. Notably, current market positioning suggests investors are displaying greater confidence in gold than in long-dated U.S. Treasuries and the U.S. dollar.

Figure 1: Gold in USD & US 10Y Real Bond Yield Inverted (Jan 2003–Jan 2026)

Sources: LBMA, U.S. Department of the Treasury

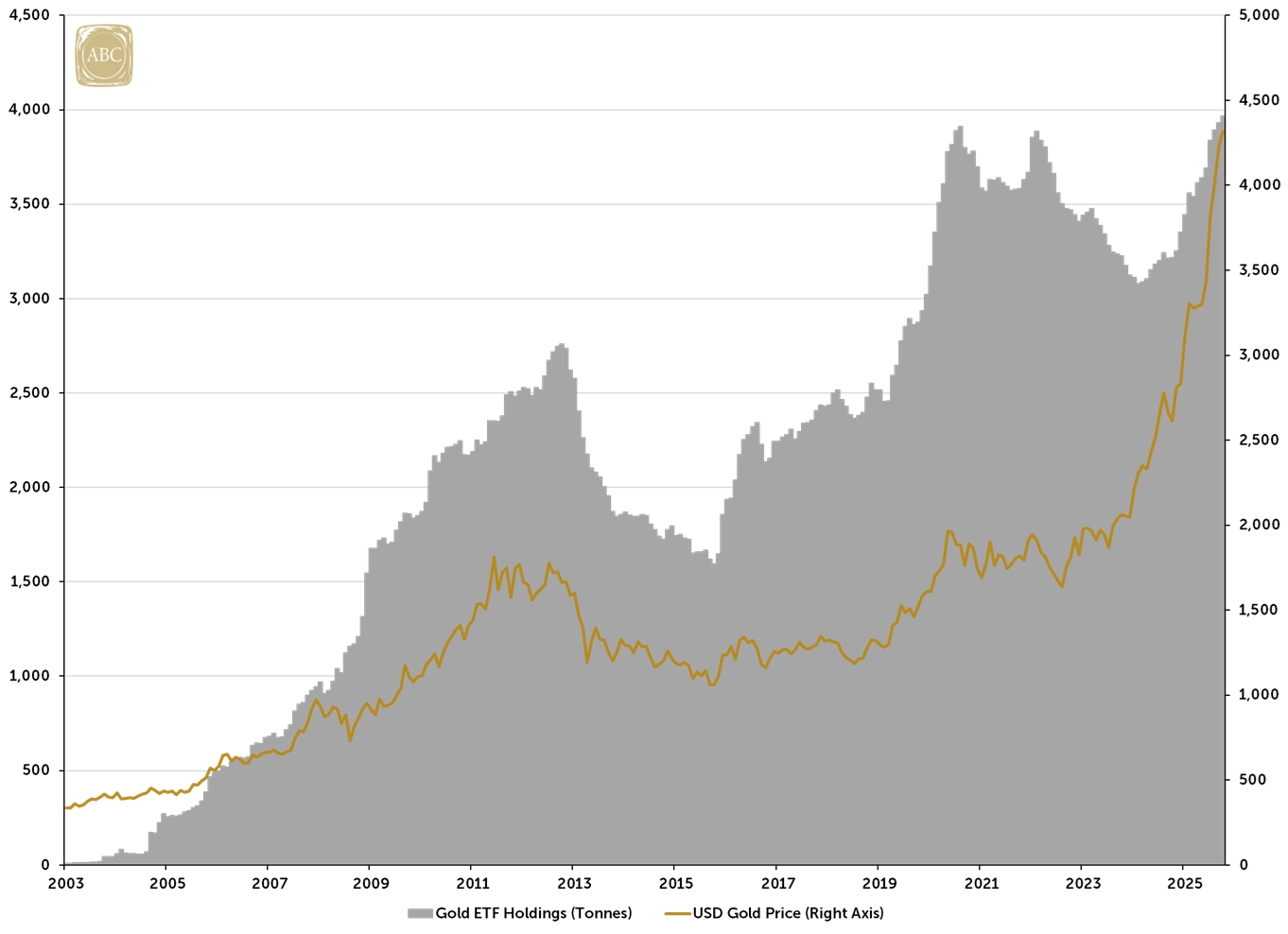

ETF flows into precious metals also remain elevated and structurally supportive. Record gold ETF inflows were a defining theme in 2025, with the value of all gold holdings in ETFs ending the year at approximately USD $550 billion or 3968 tonnes, the highest level on record (Figure 2).

This momentum has continued into 2026, as investors look to diversify portfolios.

This trend has been reflected domestically, with Australia’s largest precious metals ETF issuer, noting that that since January 1, Australians have invested an average of $19.8 million a week into gold funds, representing a 28.6% increase on the $15.4 million in average weekly flows recorded last year AFR.

Figure 2: Gold in USD & Gold ETF Holdings (Mar 2003–Dec 2025)

Sources: LBMA, World Gold Council

The increase in demand for precious metals that can be seen in the ETF market is being more than matched in the direct physical space, with ABC Bullion continuing to set near daily record in terms of dollar turnover, new client acquisition, sign ups to our ABC Bullion Gold Saver program, and demand for cast bars, minted tablets and coins.

With central bank buying also off to a strong start this year, evidenced by the Polish central bank recently approving plans to add another 150 tonnes of the precious metal to their reserves, 2026 looks set to be another rewarding one for those with healthy allocations to precious metals in their portfolio.

Thank you for choosing ABC Bullion

Jordan Eliseo

General Manager, ABC Bullion

Luke Tyler

Market and Business Analyst, ABC Bullion

Disclaimer: This document has been prepared by Australian Bullion Company (NSW) Pty Limited (ABN 82 002 858 602) (ABC). The information contained in this document or internet related link (collectively, Document) is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence any person in making a decision in relation to any precious metal or related product. To the extent that any advice is provided in this Document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of any precious metal or related product, you should obtain independent professional advice before making any decision about whether to acquire it. Although the information and opinions contained in this document are based on sources, we believe to be reliable, to the extent permitted by law, ABC and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice, and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances. To the extent possible, ABC, its associated entities, and any of its or their officers, employees and agents accepts no liability for any loss or damage relating to any use or reliance on the information in this document. It is intended for the use of ABC clients and may not be distributed or reproduced without consent. © Australian Bullion Company (NSW) Pty Limited 2020.